Teenagers like to spend money. It’s no secret ‐ in fact, it’s statistically proven. According to the research report “Taking Stock With Teen,” the average teenager spends $2,391 per year. Conscious consumerism in teens is crucial. This article will unpack some tactics that drive hyperconsumerism and some strategies for mitigating it.

Our generation, the infamous Gen Z, is the future of our society. Gen Z also happens to be the target market for businesses as we are significantly easier to persuade when it comes to consuming. To persuade us to buy, businesses use marketing strategies such as “Black Friday” and “Cyber Monday” sales. These sales are arguably the most significant days of the year for discounted items. But, where do teenagers come into this? As we know, social media has an influence on everyone, but teenagers are specifically targeted by online marketing. For example, skin care brands such as Glow Recipe market through apps like TikTok and Instagram, using trending audios and fads to reel teenagers into buying their products. “One tactic I notice businesses doing to get teenagers to spend more money, is they’ll promote their product or brand on social media and force it to be a trend, so then it’s trendy to have that product or support the business. You feel forced to match with everyone,” said sophomore at The Village School, Poli Colacelli, who is currently in the class Fundamentals of Finance, Accounting & Investment.

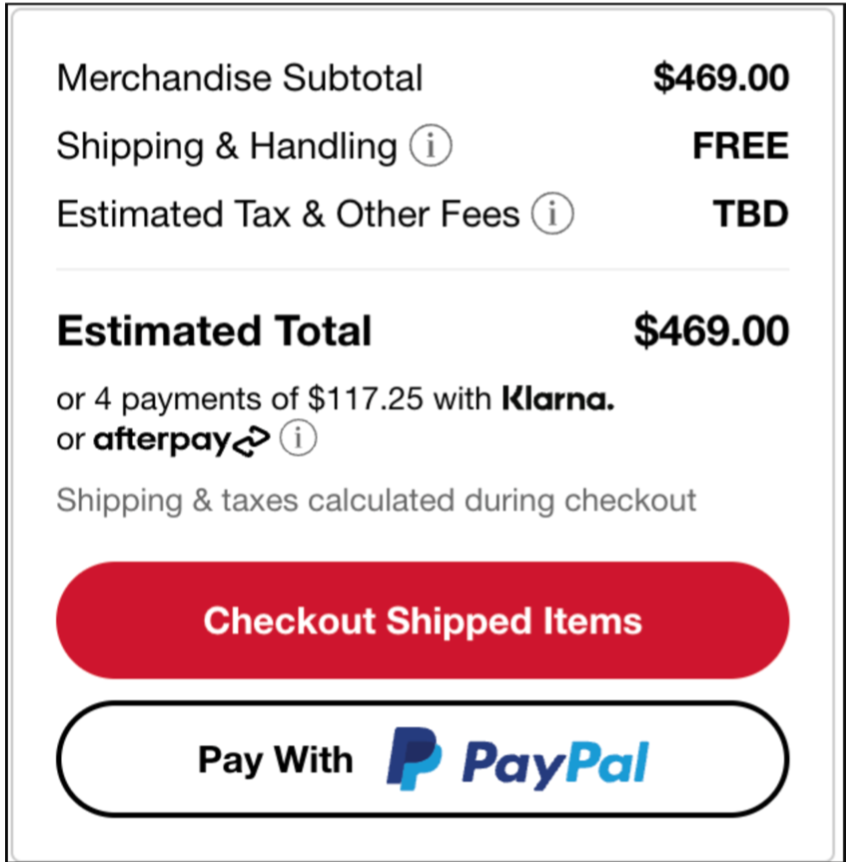

Businesses will use buzzwords like “flash sale” or “biggest sale of the year” which entice customers, specifically young ones as we are easily impressionable, to buy products because we “won’t get a deal like this again.” This is extremely compelling because teenagers aren’t the demographic making the most money in society, so naturally we want to save money and end up buying products that are “on sale” rather than buying them for their original price. In reality though, we end up spending more than we realize because we’re buying into the idea of a “big” sale.

We obviously save more money when we buy items that are on sale, but something about the word “sale” compels us to buy even more than we need. Sometimes we’re not even conscious of it, it’s just an automatic impulse to spend money. This is extremely prevalent on days like “Black Friday.” If I decide to buy a shirt on a normal day, I would most likely just buy that shirt and move on ‐ but on a day like “Black Friday,” I might go into a store to buy a shirt and exit with four shirts instead, because there was a big sale on them. These types of sales create a sense of urgency to purchase and create stress in an adolescent mind. This results in teenagers spending more money than intended. Although a big part of this cycle does fall on us and how we learn impulse control, businesses do take advantage of adolescents. Sales also create FOMO (fear of missing out) on big deals. Businesses will play into the stress teenagers have when we don’t have the latest or hottest product. Ultimately, sales create false urgency and stress which ends up with the businesses gaining more money than ever.

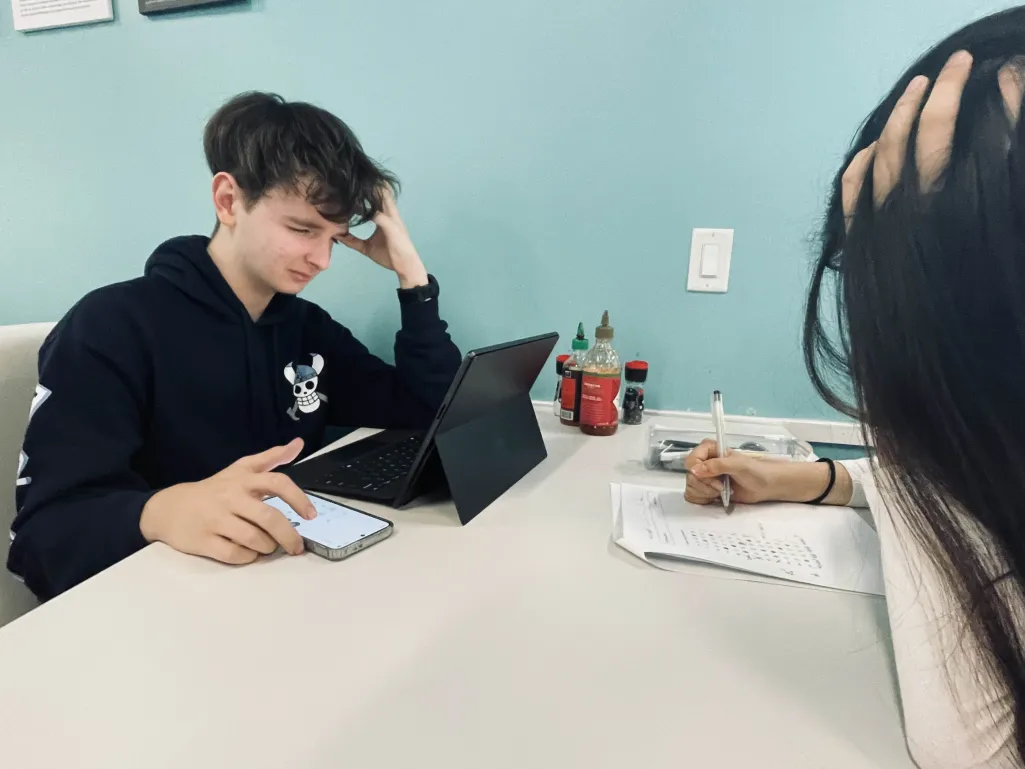

“One thing I do to refrain myself from spending money is bringing my dad in with me since he’ll make me reflect on my purchase before I buy it,” said sophomore Poli Colacelli. Although we are young, it doesn’t mean we are unaware. We have awareness of what we spend and should strive to find solutions to impulsiveness. This insight can help us tap into the future of financial habits and how to form good ones early on. Creating strong will power over your financial actions as a habit helps form a strong financial foundation to your adult life. The struggles that many adults go through regarding financial mistakes could be mitigated if good habits are formed from day 1.

Shifting from an adolescent view, what do our educators see? “I teach Fundamentals of Finance, Accounting, and Investment, and Business and Professional Skills, and Introduction to Entrepreneurship,” said teacher at The Village School, Andrea Sealy. “In my classes, especially in Finance, we cover customer awareness, financial literacy, purchase power and overall, the power money has” said Mrs. Sealy. “Some advice I would give teenagers is to one, have your own account so you can be aware of how you use and apply your money, and two, have your own credit card to work on your budget. Be the owner of your own money and stay aware.” In my opinion, both having your own account and understanding the value of your purchase are two of the most important solutions when it comes to consumerism. Not only are you seeing the consequences to purchasing when you have your own account, but you also understand where your money goes when you comprehend the power one purchase can have.

As teenagers, we’re overlooked in the business world and seen as easy targets, but this doesn’t have to go on! Apply awareness for yourself, take advice from your fellow educators, and become the owner of your own money!

References

Yaqub, M, ( May,2023).22+ Fascinating Teenage Spending Statistics That Need to Know in 2023 %5BInfographic%5D. BusinessDIT. Retrieved November , 2023

from https://www.businessdit.com/teenage-spending-statistics/